Motorcycle Financing HP-i

General Benefits

Flexible Loan Tenure

Low Rates

Wide Variety of Brands

Features & Benefits

Fast Approval & Hassle Free

Approved within 3 working days for normal applicants and express card holders.

High Financing Amount

Enjoy up to 90% financing for qualified customers.

Hassle-Free Payment Methods

Choose from a variety of payment channels for hassle-free Payment.

Shariah Compliant

Shariah-compliant and governed under the Hire Purchase Act 1967.

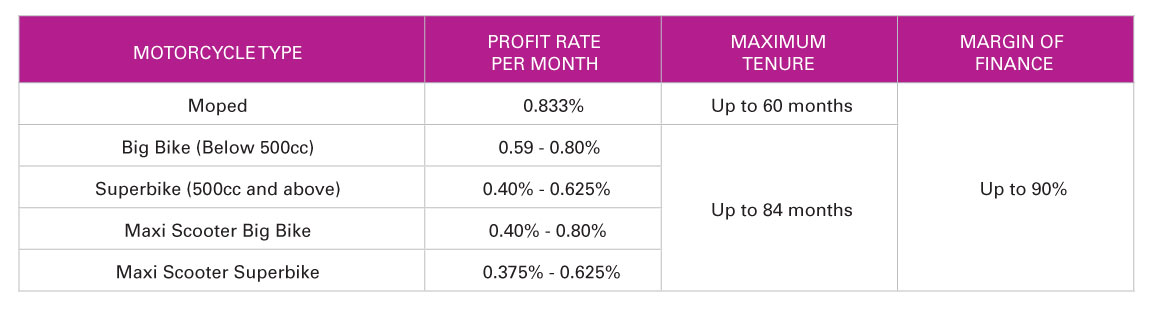

Motorcycle Types

Bikes below 250cc.

Rate as low as 0.833% per month.

Flexible tenure applies to new & used motorcycle.

- New: Instalment periods from 12 to 60 months.

- Used: Instalment periods from 12 to 48 months.

Rate as low as 0.65% per month.

For new motorcycles, there is a flexible tenure of up to 48 months.

Bikes 250cc and above.

Rate as low as 0.375% per month.

Enjoy the flexi financing tenure from 12 to 84 month.

Financing is available for new and used superbikes.

Financial solutions available for a diverse array of brands.

Eligibility & Required Documents

Eligibility

Individual:

- Malaysian citizen aged 18 to 65 years old

- Applicants should be employed for at least 6 months in current employment

- Minimum monthly gross income: RM1,050 (WM), RM920 (EM)

- Office telephone number and HP/home telephone number is compulsory

- One contactable referee

- Applicant must be contactable

Self-Employed:

- Malaysian citizen aged 18 to 65 years old

- Self-employed applicants' current employment must be at least 1 year

- Minimum monthly net pay: RM1000.00

- Office telephone number and HP/home telephone number is compulsory

- One contactable referee

- Applicant must be contactable

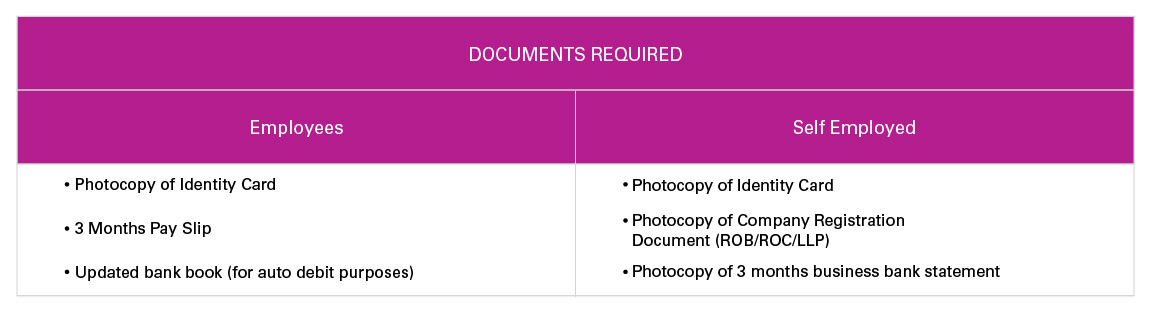

Documents Required

Individual Applicant:

- One photocopy of I/C (front and back).

- Photocopy of 1 month proof of income or EPF statement.

- Latest Bank Proof.

Self-Employed:

- Business Registration Form.

- Photocopied I/C of proprietor/partners/directors (front and back).

- Latest 3 months company bank statement.

Payment Methods

Auto Debit Facilities

Alliance Bank, Ambank, Bank Muamalat, Bank Simpanan Nasional, CIMB Bank, Maybank, Public Bank, RHB Bank and Standard Chartered Bank

Over the Counter

Available in Maybank, Alliance Bank, Public Bank, Bank Simpanan Nasional and Payment at Merchant (PAM)

Cash Deposit Machine (CDM)

Available in all AEON Credit Service Branches, Maybank, CIMB Bank, Public Bank and Alliance Bank with 24 hours service

MEPS Interbank GIRO

Payment through MEPS Interbank GIRO at any participating banks and through Internet Banking

AEON Wallet Malaysia

Conveniently manage transactions and enjoy hassle-free payments across various merchants and services with your AEON Wallet Malaysia app

FAQs

- What is AEON Motorcycle Financing HP-i?

Motorcycle Financing HP-i is a Shariah-compliant financing product granted to end consumer for purchasing motorcycle.

- Does AEON Motorcycle Financing HP-i governed under the Hire Purchase Act 1967?

Yes.

- Do I need to purchase motorcycles from the AEON Credit's appointed dealers?

Yes, AEON Credit has more than 1000 appointed motorcycle merchants throughout the nation at your convenience.

- What documents do I need to submit?

Note: AEON Credit Service reserves the right to request for additionally supporting documents if deem necessary.

- What brand of motorcycles do AEON Credit Service (M) Bhd finance?

We finance a wide range of brands of motorcycle, Kawasaki, Yamaha, Honda, SYM, Modenas, Suzuki, Scomadi, KTM, BMW, Ducati, Harley Davidson, Benelli, Moto Guzzi, Motor Morini, QJ Motor, Royal Alloy, Royal Enfield, MForce Premium, Wmoto, Aveta, Adiva, Brixton, GPX, Pulsar, MLE, SM Sport, Zontes, Aprilia, MV Agusta, Triumph, Moto Guzzi, Keeway, Naza, Vespa, Piaggio, Kymco, CMC, Momos, Daiichi, KTNS, Husqvarna, Zero Engineering, Blueshark, Aveta & Yadea.

- What is the Loan Tenure for AEON Credit Service's Motorcycle Financing HP-i?

We do provide flexi instalment tenure up to customer’s choice. Moped and Superbike instalment tenure range from 12, 24, 36, 48, 60 to maximum 84 months on selected models.

- What type of schemes available under AEON Credit Service's Motorcycle Financing HP-i?

Financing Package

- What should I do in the event of renewing my road tax?

You can simply visit any of our appointed motorcycle dealers for renewing road tax wherever you are.

- What are the benefits of AEON Credit Service's Motorcycle Financing HP-i?

We provide flexible instalment period up to 84 months at our customer choice. We offer attractive profit rate and high Margin of finance.

- Is it compulsory to have a guarantor in order for the loan to be approved?

Guarantor provision is not compulsory.

- How many payment channels does AEON Credit Service provide?

1. Cash Deposit Machine (CDM)

•Available in all AEON Credit Service Branches, Maybank, CIMB Bank, Public Bank and Alliance Bank with 24 hours service

2. Over the Counter (OTR)

•Available in Maybank, Alliance Bank, Public Bank, Bank Simpanan Nasional and Payment at Merchant (PAM)

3. Auto Debit Facilities

•Alliance Bank, Ambank, Bank Muamalat, Bank Simpanan Nasional, CIMB Bank, Maybank, Public Bank, RHB Bank and Standard Chartered Bank

4. Interbank GIRO (IBG)

• Local & Foreign Commercial Bank

5. Post Dated Cheque(P.D.C.)

• To provide 12 P.D.C. if customer selected the repayment mode by P.D.C.

6. AEON Wallet Malaysia

•Hassle-free payments across various merchants and services with your AEON Wallet Malaysia app - Will my personal information be confidential?

Yes.

- What should I do if I lose my motorcycle?

Step 1

- Lodge a police report on the lost of Motor Vehicles at the nearest police station immediately (within 24 hours).

- Obtain and fill in the insurance claim form from the relevant insurance company.

- Prepare the following documents:

- Copy of Mykad

- Copy of valid license

- Original copy of road tax (if any)

- Original copy of police report

- Copy of vehicle registration card/Vehicle Ownership Certificate (if received)

- Copy of insurance cover note

- Copy of Sales & Purchase Agreement

Step 2

- Submit the above documents (from Step 1) to AEON.

- Obtain the latest outstanding balance account from AEON.

- Update personal information:

- Latest address

- Latest contact number (mobile, house & office)

Step 3

- Continue to service the monthly instalment as per payment schedule.

- Follow up on the insurance claim status with the insurance company (at least once a month). IMPORTANT: Please ensure that AEON & the insurance company have your latest contact numbers, particularly your mobile number so that they can update you on any new information.

Document Downloads

Loan Calculator

Our helpful tool to help you calculate your monthly instalments (subject to final approval).

Motorcycle Financing HP-i

Apply for Motorcycle Financing HP-i Today

Finally, it's time to ride your dream motorcycle home. With installment periods up to 84 months, our Motorcycle Financing HP-i makes owning one a whole lot easier.